Why I like NEAR

The team is strong. I would even go on and say one of the best teams in crypto. Alex had a career working for Microsoft as a software engineer, and Illia worked in engineering at Google. This gives me confidence that they will be able to solve arising problems quickly and ship innovation at speed, which is crucial in crypto as the speed of innovations are rapid in crypto. Their experience working at Web2 is also reflected in some of the toolings they have used; for instance, the wallet, the public key is a human-readable address (similar to ENS). Mine is mehdifarooq.near

It’s Ethereum Virtual Machine (EVM) compatible. This allows Ethereum developers to easily port over applications via Aurora.

NEAR is like the Ethereum 2 roadmap but implemented early. NEAR’s approach to scalability is similar to Ethereum 2.0 in that it leverages sharding. Sharding breaks the blockchain history into smaller pieces, which allows them to be stored across different parties. In doing this, it distributes the load storage, processing, and computation across multiple nodes to increase network speed and scalability. Each node can process and hold a piece of the overall state rather than every transaction. They are also implementing dynamic re-sharding. In Polkadot and ETH 2.0 the number of shards is static; with dynamic sharding, the shards can be added and removed dynamically as per demand. For instance, if an application running on a shard starts to create congestion in the network, the validator can separate the contract from another shard. This will solve the bottleneck, and TPS can scale.

Octopus network is developed on top of NEAR. This allows developers to build and launch their own “app chains” (application-specific blockchain) that are designed for specific use cases and built via Polkadot Substrate. This can potentially allow the Polkadot-based project to launch on Near at a 40x-50x cheaper cost.

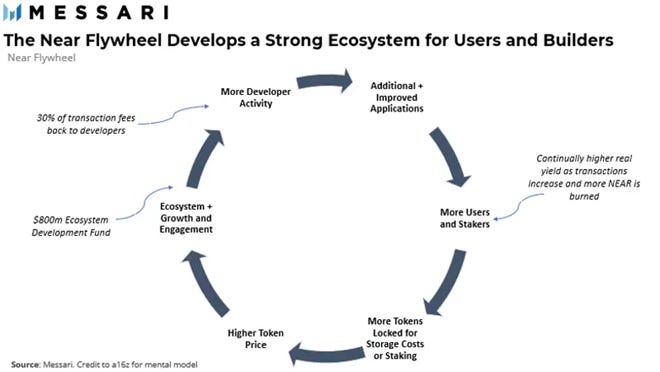

Token Utility is strong. Network security (through staking), transaction and data storage fees, medium of exchange, and a unit of account. The storage is unique as you need to hold some NEAR in your account to essentially pay for network storage. This amount grows as the storage you need grows. This dynamic requires those who use the network more to put more at stake, reducing the likelihood of bad actors spamming the network. For the distribution of fees, 70% of transaction fees on NEAR are burned, with 30% being sent to the creator of the smart contract the user is interacting with.

The token Utility, along with an $800+m ecosystem fund, creates a strong flywheel and feedback loop for developers, users, and stakers

Risks

Most of the development within the NEAR ecosystem is on the Aurora( EVM compatible application). While it’s great that developers can easily port apps and over 90% of NEAR TVL is on Aurora. But this prevents native ecosystem development and bootstrapping.

Marketing and Brand Awareness: There is a lack of branding and marketing for NEAR. NEAR has produced strong technical content, particularly their whiteboard series, but has not found a direct connection to non-technical normies. Now compared to Terra (Do Kwon), Avalanche (Emin Gün Sirer), BNB (CZ), and Cardano (Charles) they have been able to narrate their story far better. Maybe they will come to the 100X show.

L1 competition. Near is competing for users and developers with multiple L1s like Terra, Solana, Avax, and ETH 2.0 (with roll-ups)

Conclusion

The team and technology behind NEAR are high quality. Since L1 price appreciation is mostly dependent on the network effect. That is, in turn, a function of market adoption (user and developers). The most significant headwind NEAR faces atm is also market adoption. Once they overcome this, the flywheel will start spinning viciously. When it does, I don’t see why NEAR cant be amongst the top 10 in mcap.