Disclaimer: Nothing in this article is investment, tax, legal, or other financial advice. The views, thoughts, and opinions expressed in this piece are solely those of the author and do not represent the views of the author's employer, organization, committee, or other group or individual. The author's employer is not responsible for any content provided here. All statements made are the author's personal views and do not reflect those of their employer.

Overview

Website:https://www.eigenlayer.xyz/

Sector: Infrastructure and DeFi

Ecosystem: Ethereum

PitchDeck:https://drive.google.com/file/d/16rM9Ew3B2k3DoJ7UjMGCHMOQORQQLV21/view

Whitepaper:https://docs.eigenlayer.xyz/overview/readme

Twitter:https://twitter.com/eigenlayer

TG: @sreeramkannan

Podcast with Mehdi:EigenLayer: Does Re-staking Negate the Need for Native Middle-Layer Tokens? | The Open Metaverse

Deal Details

Round Size: $50M

Valuation: $250M post-money (1:2 token warrant)

Stage: Series A

Other Investors Blockchain Capital( Lead) Electric Capital, Polychain Capital, Hack VC, Finality Capital Partners, and Coinbase Ventures

Project Summary

EigenLayer facilitates ETH re-staking, allowing stakers to accumulate compounded returns while securing other networks beyond Ethereum.

Re-staking optimizes capital efficiency for those holding ETH and allows protocols developed on EigenLayer to benefit from shared security without building from the ground up.

The emergence of an open marketplace featuring middleware and validators introduces innovative modularity for blockchain stacks such as data availability, oracles, MEV management, bridges, messaging, and beyond.

Problem

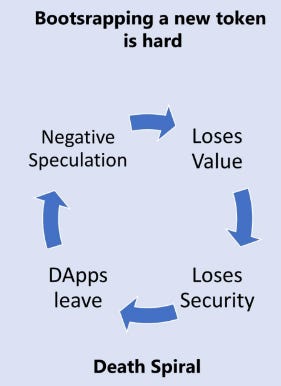

Bootstrapping validator networks (L1s/L2 and middleware) presents significant challenges due to the direct exposure of the security incentive to the native token's price.

For example, the risk of a 51% attack becomes easier when a Layer 1/2 FDV is substantially lower than the economic security required by applications using it. Consequently, due to these security concerns, bluechip DeFi projects seldom deploy on low market caps and less utilized Layer 1/2 solutions. This cold-start problem also extends to middlewares like Oracles. MEV management, Bridges, messaging layers, and DA solutions where they must create their decentralized trust networks from scratch.

Needing to improve capital efficiency.

Securing the Ethereum network would generate a base yield akin to a “risk-free” rate. What if one has the opportunity to “re-stake” their ETH and get a boost in their yield for additional units of risk taken (slashing)? For example, applications, oracles, layer-2s, and those willing to offer ETH re-stakes yield in their native token to secure their networks, effectively creates a staking market that boosts yield.

Solution and Business Model

The native validation model of crypto-networks creates a cold-start issue for new blockchains and middleware, which could fail if they can't secure a certain initial market cap/FDV.

EigenLayer allows these new and existing L2/L1/middleware solutions to leverage Ethereum's economic security for transaction validation and security. They are allowing decoupling of network security from the token price. This means these solutions can focus on their core value proposition, not worrying about liquidity, capital, or increasing the validator set.

Thesis

Large and growing TAM.

The current staking market comprises approximately $75bn worth of staked crypto assets that are being used as collateral to secure PoS networks, out of which 48% is locked in Ethereum 5X more than the second largest blockchain by the stake.

Even though Ethereum staking is still in its infancy (the merge happened in the fall of 2022), it still serves a large market, rapidly growing at a CAGR growth of 153.5% in the last two years (chart below). If we assume, on average, Ethereum staking grows at a CAGR of 50% for the next five years, the market TAM would estimate to be 268BN.

Evidence of market appetite/PMF for yield enhancement product.

PoS architecture has facilitated the emergence of new features like LSD, a staking market subcategory that's amassed a $19bn Total Value Locked (TVL), indicating strong market interest. Similarly, re-staking would also create substantial liquidity, as both areas enhance yield opportunities and boost capital efficiency.

EigenLayer could exhibit winner-take-all dynamics as observed in the LSD market structure, with first-mover gaining a significant edge.

For example, Lido has currently captured 75% of the Ethereum LSD market and was also the first mover in this space. Trust-building is crucial due to the risk of ETH slashing. Still, once established, it increases user switching costs, fosters retention, and leads to market leadership, as observed with Lido.

Nervous Vitalik

This technology's potential impact is significant, as a blog post from Vitalik Buterin indicates. Instead of seeing this as a risk, this signifies in a contrarian way protocol's disruptive capacity. Vitalik's early caution to the community to avoid Ethereum forks underscores this. The only risk of a fork emerges if EigenLayer grows to command the majority of Ethereum validators, and any middleware issues could instigate a conflict leading to a fork.

Gifts. The optionality of upside from ancillary products that are part of their GTM and setting up the supply side of their marketplace

To bootstrap the two-sided network effect of their marketplace, part of their initial GTM is to build a data availability layer for Ethereum called EigenDA (akin to Celestia,l,zkPorter) which leverages EigenLayer to bootstrap the security of the DA layer. Mantle Network (read BitDao chain) will be leveraging EigenDA for data availability of their L2.

Regarding their product roadmap, they also have plans to launch Eigen MEV (akin to Flashbots). Both products, on a standalone basis, if successful, could garner valuation in billions of dollars (based on current relative valuation).

Risk to our Thesis

Removing validation from a token model makes it less valuable, which could lead to a catch-22 for Eigenlayer regarding value accrual and adoption. This could also establish a significant entry barrier for projects utilizing EigenLayer, reminiscent of Polkadot, where the auction mechanics and shared security hindered adoption as the native token of their parachain lost its purpose. This is a critical risk. For projects to give up their native token is a hard ask. However, for ideological reasons, there could still be adoption and a whole new path dependency that gets created because of this.. Some evidence of this is Mantle adopting EL for data availability.

EigenLayer's viability depends on a rebalancing algorithm that evaluates validators based on their stakes and security usage. Any issues, such as latency or incorrect parameters, could make EigenLayer vulnerable to attacks. Additionally, designing this algorithm could have steep technical hurdles and require multiple iterations.

The platform faces a typical cold-start problem, as they need to attract a diverse range of middleware suppliers, and managing and initiating these supply-side relationships poses an execution risk.

Slashing conditions could be reduced by middleware to draw more capital, risking security and potentially enabling a 51% attack, thereby fueling fears about re-staking.

Centralization risk is possible if many stakers support one middleware and get slashed, which could cause an Ethereum hardfork and negative sentiment toward re-staking. There are also some concerns as more ETH gets restaked and if EigenLayer gains control of the majority of circulating ETH (similar to Lido).

The risk of verticalization also exists where a re-staking marketplace specializes or monopolizes a particular middleware domain. This could lead to reduced fees for catch-all marketplaces due to competitive pressures and significantly reduce the TAM we envisioned for EL.

The risk of commoditization of a re-staking marketplace is similar to what we have lately seen with NFT marketplaces - this can also significantly reduce pricing power and hence reduce fees.

The upside to our thesis (Bull Case)

More traditional web2 companies and gaming studios might develop their app chains (AWS, Shrapnel, Gunzilla, etc.) and blockchain middleware. They might need help to bootstrap their decentralized security via a token model and hence could leverage re-staking to bootstrap their security.

EigenLayer capitalizes on the diversity of Ethereum's nodes, allowing protocols to select nodes best fitting their needs for validation - be it KYC'd nodes, geographically specific nodes, or those with surplus computing resources. This could facilitate the emergence of new L1 solutions atop Ethereum, catering to various blockchain trilemma trade-offs.

EigenLayer could simplify app chain development on Ethereum by reducing verification costs for ZKRUs, providing a cost-effective DA layer with high throughput, and offering a decentralized sequencer set. This could amplify Ethereum's network effect and drive EL's usage as a "security services" platform even more.

Competition

Exocore, a multichain pooled security protocol incubated by Shima. Although the Omni-chain design has more technical hurdles, it could generate stronger network effects as 52% of staked liquidity is still outside Ethereum, and their architecture could leverage staked tokens inside and outside Ethereum.

Cosmos can be regarded as another competitor. Different flavors of shared security are also emerging from that ecosystem:

Replicated Security requires every Cosmos Hub validator to validate for Cosmos sidechains opting for this feature. While facilitating IBC messaging among consumer chains and the Cosmos Hub, creates computational overhead and centralization risk as validators must run multiple sidechain nodes concurrently.

Mesh Security allows Cosmos consumer chains to share security with one another, thereby extending a sidechain’s security ceiling beyond its native token’s market cap.

Babylon functions within a market that is equivalent but distinct from re-staking, it employs checkpointing on Bitcoin to ensure additional security for the Cosmos app chain (limited by 100 validators and low market cap). Sreeram (co-founder) was also an advisor to this project.

Avalance subnet and cross-staking are also similar to EL. In the Avalanche ecosystem, validators of the Avalanche Primary Network can concurrently participate in other subnets’ PoS consensus and secure them, provided they fulfill the requirement imposed by those subnets.

Current LSD platforms, due to their market positioning, could potentially pivot towards re-staking and go for staking super app.

EigenLayer need not concern itself unduly with Cosmos and Avalanche, mainly due to their lower Nakamoto coefficients relative to Ethereum, indicating a smaller, less diversified set of validators that limits the extent of shared network effects. One also can’t discount the ideological fervor of the Ethereum community, which could be one catalyst for wider adoption. Furthermore, the shared security models on these blockchains primarily cater to the L1s and do not extend broadly to middleware. Consequently, EigenLayer is leveraging its unique positioning to establish a wider market presence.

While there may be concerns about dominant LSD platforms like Lido entering the market, they would face considerable technical challenges and have to divert their focus away from the burgeoning LSD market. However, Lido's competitive edge lies in its vast distribution network of staked Ethereum and the trust they've established with users.

Team

Their core team has diverse experience in academia, operation, and investments.

Sreeram Kannan (Founder and CEO)

He founded Eigenlayer and is an Associate Professor at the University of Washington, researching Information Theory and its application in blockchain, AI, and computational biology.

He was also the Director of the UW Blockchain Lab. His academic journey includes a stint as a postdoctoral scholar at the University of California, Berkeley, and a visiting postdoc at Stanford University from 2012 to 2014. Before these roles, he earned a Ph.D. in Electrical Engineering and has a double master's M.S. in Mathematics from the University of Illinois Urbana Champaign and an M.E in Telecommunications from the Indian Institute of Science (IISc).

One thing that stands out about Sreeram is how he articulates complex ideas and concepts simply and crisply. This attribute will help him successfully market his vision of hyperscaling Ethereum via EigenLayer to retail and institutional investors. Additionally, his strong academic and research background gives him an edge in the evolving market of re-staking and crypto-economic security.

Chris Dury (COO)

A wealth of experience in establishing, counseling, and investing in early-stage startups. His portfolio includes Salut, a fitness streaming community, and Apsalar, a mobile marketing platform that was later acquired by Singular. He also contributed to Ooma, a cloud-based phone service with an IPO, Prove Identity, a mobile identification service, and Tempo AI, a smart mobile calendar sold to CRM.

Regarding his work experience, he was the GM and Director at AWS for five years, leading teams of 100+ engineers, product managers, designers, and marketers for three AWS services. Also created Merch by Amazon and established the Twitch teams focused on game developers.

He has an MBA from NYU and a Bachelor in Economics from Michigan State University.

Calvin Liu (CSO)

He was the Strategy Lead of Compound Labs (Compound Finance, $COMP) and investor alongside Divergence Ventures. This crypto-focused venture fund has invested in protocols including Frax, Lido, Compound, Gitcoin, etc.

Earlier in his career, he was an M&A analyst at Houlihan Lokey and had a BA in Philosophy and Economics from Cornell University.

Summary

I like it a lot!

Disclaimer: Nothing in this article is an investment, tax, legal, or other financial advice. The views, thoughts, and opinions expressed in this piece are solely those of the author and do not represent the views of the author's employer, organization, committee, or other group or individual. The author's employer is not responsible for any content provided here. All statements made are the author's personal views and do not reflect those of their employer.

Great article, here’s to many more!

Great article Mehdi!! Good to see you back!